Exactly How Animals Danger Defense (LRP) Insurance Coverage Can Secure Your Livestock Financial Investment

In the realm of animals investments, mitigating threats is critical to making certain financial security and growth. Livestock Threat Protection (LRP) insurance coverage stands as a dependable guard versus the unpredictable nature of the marketplace, offering a tactical strategy to safeguarding your possessions. By diving into the complexities of LRP insurance policy and its multifaceted benefits, livestock manufacturers can fortify their investments with a layer of safety that goes beyond market fluctuations. As we check out the world of LRP insurance policy, its role in securing livestock financial investments comes to be increasingly obvious, guaranteeing a course in the direction of lasting financial resilience in an unstable market.

Comprehending Animals Danger Defense (LRP) Insurance Policy

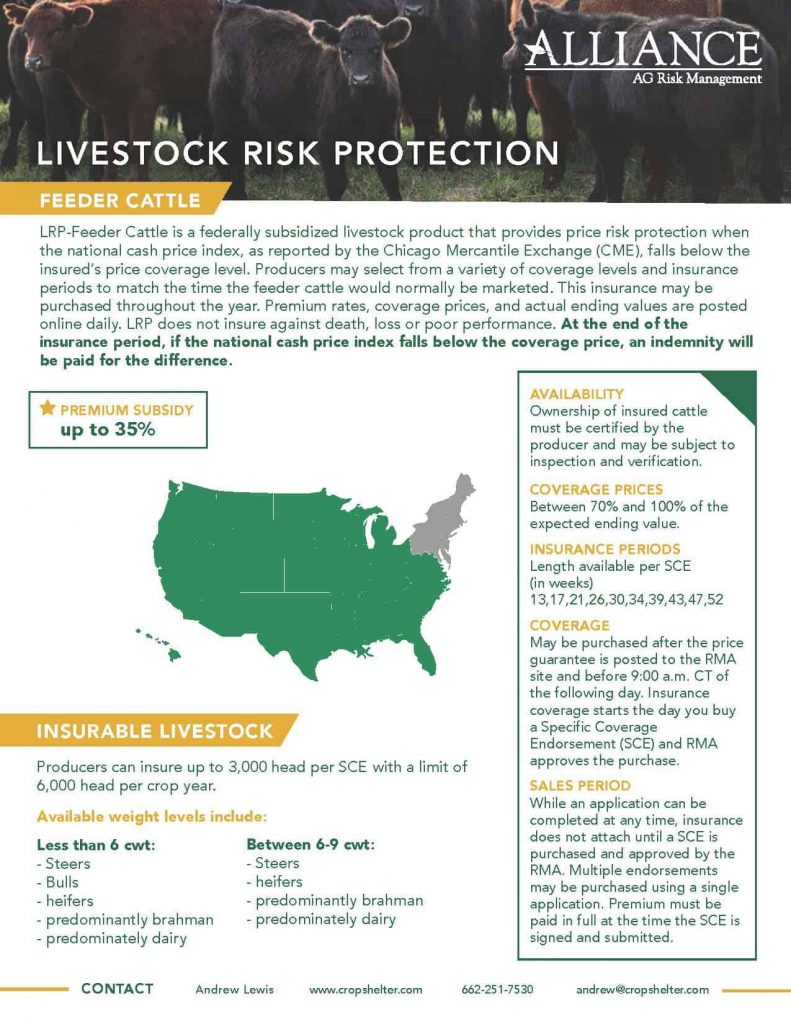

Comprehending Livestock Threat Security (LRP) Insurance is essential for livestock producers seeking to minimize financial risks connected with cost fluctuations. LRP is a government subsidized insurance item developed to protect manufacturers versus a decrease in market value. By supplying coverage for market rate declines, LRP aids producers secure in a floor cost for their animals, guaranteeing a minimal level of earnings despite market changes.

One key element of LRP is its adaptability, enabling manufacturers to customize protection degrees and policy lengths to match their specific requirements. Manufacturers can choose the number of head, weight array, coverage cost, and insurance coverage duration that align with their manufacturing objectives and risk tolerance. Comprehending these personalized options is vital for manufacturers to effectively manage their cost threat direct exposure.

Moreover, LRP is offered for different animals kinds, consisting of livestock, swine, and lamb, making it a functional risk management tool for livestock producers throughout various fields. Bagley Risk Management. By acquainting themselves with the intricacies of LRP, producers can make informed decisions to secure their financial investments and make certain economic security despite market unpredictabilities

Advantages of LRP Insurance for Livestock Producers

Animals producers leveraging Livestock Risk Defense (LRP) Insurance gain a tactical advantage in shielding their investments from price volatility and securing a stable financial ground among market unpredictabilities. One vital advantage of LRP Insurance coverage is cost security. By setting a floor on the rate of their animals, manufacturers can alleviate the danger of significant financial losses in the occasion of market declines. This enables them to prepare their budgets more effectively and make educated choices regarding their operations without the consistent anxiety of cost changes.

Additionally, LRP Insurance provides producers with tranquility of mind. Overall, the advantages of LRP Insurance policy for animals manufacturers are considerable, providing an important tool for managing risk and ensuring financial security in an uncertain market setting.

Exactly How LRP Insurance Coverage Mitigates Market Risks

Mitigating market threats, Livestock Threat Security (LRP) Insurance gives animals producers with a dependable guard against rate volatility and monetary unpredictabilities. By using protection versus unexpected rate drops, LRP Insurance policy assists manufacturers protect their financial investments and preserve financial stability despite market changes. This kind of insurance coverage allows livestock manufacturers to secure a price for their animals at the start of the policy duration, guaranteeing a minimal price level despite market changes.

Actions to Protect Your Livestock Investment With LRP

In the world of farming risk administration, carrying out Animals Risk Security (LRP) Insurance coverage entails a strategic process to safeguard investments versus market fluctuations and unpredictabilities. To protect your animals financial investment effectively with LRP, the very first action is to examine the details risks your operation faces, such as cost volatility or unforeseen weather condition occasions. Next off, it is critical to research and select a respectable insurance policy provider that offers LRP policies continue reading this tailored to your animals and business needs.

Long-Term Financial Security With LRP Insurance

Ensuring enduring financial security via the application of Animals Danger Security (LRP) Insurance coverage is a prudent long-term approach for farming manufacturers. By integrating LRP Insurance coverage into their threat monitoring strategies, farmers can protect their livestock financial investments versus unanticipated market changes and adverse occasions that can endanger their financial health gradually.

One secret benefit of LRP Insurance policy for long-lasting financial security is the comfort it uses. With a reputable insurance coverage in location, farmers can mitigate the economic dangers connected with unpredictable market problems and Website unexpected losses as a result of elements such as disease break outs or natural calamities - Bagley Risk Management. This stability permits producers to concentrate on the daily procedures of their livestock organization without continuous fret about potential monetary setbacks

Additionally, LRP Insurance supplies a structured technique to taking care of danger over the lengthy term. By setting certain coverage levels and picking suitable recommendation durations, farmers can tailor their insurance coverage plans to line up with their economic objectives and risk resistance, guaranteeing a sustainable and protected future for their animals operations. In final thought, investing in LRP Insurance coverage is an aggressive technique for farming manufacturers to achieve enduring economic security and safeguard their source of incomes.

Verdict

In final thought, Livestock Risk Protection (LRP) Insurance is a beneficial device for animals producers to reduce market risks and safeguard their financial investments. It is a smart option Continue for protecting animals financial investments.

Comments on “Bagley Risk Management : Safeguarding Your Service Future”